Fishery

Fish landings appear to be

headed to a higher level for the fourth consecutive year led mainly by strong gains in

capelin, crab, and shrimp. Total landings in the January to September period were up by

about 30 percent over the same period last year. These results are ahead of earlier

expectations, however, given the early start of the crab fishery in particular,

performance on a year-over-year basis should gravitate toward the Province's forecast of

about 15 percent made in the Spring. Other major fisheries commenced on time in line with

weather and resource conditions.

Fish landings appear to be

headed to a higher level for the fourth consecutive year led mainly by strong gains in

capelin, crab, and shrimp. Total landings in the January to September period were up by

about 30 percent over the same period last year. These results are ahead of earlier

expectations, however, given the early start of the crab fishery in particular,

performance on a year-over-year basis should gravitate toward the Province's forecast of

about 15 percent made in the Spring. Other major fisheries commenced on time in line with

weather and resource conditions.

Much of the credit for smooth operations within the industry goes to the

introduction of the fish arbitration process implemented this past year. The process,

which is used when normal fish price bargaining processes reach an impasse, provides for

an independent arbitrator's review of both harvesters' and processors' arguments with a

goal of selecting the one that is supported by, and better reflects, prevailing market

conditions. This new approach was used successfully six times this year which ensured, for

the most part, a smooth transition from one species and season to the next without any

downtime in harvesting or processing activities.

Higher fish landings were achieved and a ready market identified for most

seafood products. This occurred despite deteriorating economic conditions worldwide

particularly in Asian markets--regions that tend to be large consumers of seafood such as

capelin and crab. In the case of capelin, not only did the Japanese market take the bulk

of female production but transaction prices were higher. Capelin landings rose

significantly this year to 39,878 tonnes (86% quota utilization) from 21,310 tonnes in

1997 because of an increase in the presence of suitably sized capelin. Notwithstanding the

economic problems currently being experienced in Japan, prices rose because Iceland and

Norway were unable to meet traditional market demands with product of sufficient size and

quantity. As a result, most capelin trades this year recorded prices (in US dollars) that

were substantially above those recorded last year.

Fish Landings (tonnes) Fish Landings (tonnes)

Newfoundland and Labrador

|

| Category |

First Nine Months '97 |

First Nine Months '98 |

Change |

| Shellfish |

94,508 |

123,505 |

30.7% |

| Pelagics |

34,123 |

52,476 |

53.8% |

| Groundfish |

29,938 |

30,610 |

2.2% |

| Total |

158,569 |

206,591 |

30.3% |

Source: Provincial Department of Fisheries and Aquaculture |

Crab landings rose substantially during the period mainly because of an

early start and good catches. However, since overall quotas were comparable to last year,

landings by the end of 1998 should be on par with 1997. Improved demand in US markets more

than made up for reduced demand around the Pacific Rim. U.S. dollar prices for most crab

products were, on average, lower than last year, however, when sales were converted into

Canadian dollars revenues were actually higher due to currency depreciation.

On the south coast of the Province, cod is starting to make a comeback.

The quota for 1998, at 20,000 tonnes or double last year's assignment, is expected to be

fully utilized. Unchanged is the fact that approximately 80% of the quota will accrue to

Newfoundland interests; most of the remainder is split with France in recognition of the

terms of the St. Pierre boundary decision made in 1992. Market conditions for most cod

products continue to be firm. In the New England region, the main market for cod, prices

are fluctuating at high levels reflecting strong demand, low inventories and a general

decrease in the availability of cod from other traditional suppliers.

The single largest contributor to the improved fisheries

performance this year is the northern shrimp fishery. For the first nine months of 1998,

shrimp landings rose by 25,985 tonnes accounting for approximately 54% of the overall

improvement in landings. Beginning in 1997, and expanding in 1998, most of the growth in

northern shrimp allocations have been directed toward the inshore fishing sector. The

result has been substantial investment by both the harvesting and processing sectors in a

growth area that generated substantial economic benefits throughout many areas of the

Province. Between 1993 and 1998, shrimp quotas in the Atlantic region have mushroomed from

51,601 to 84,960 tonnes reflecting strong growth in the resource. Shrimp landings for the

year are expected to approximate 55,000 tonnes which, if realized, would make it the

number one species currently prosecuted by the industry, and the Province one of the

largest producers of cold water shrimp in the world.

The single largest contributor to the improved fisheries

performance this year is the northern shrimp fishery. For the first nine months of 1998,

shrimp landings rose by 25,985 tonnes accounting for approximately 54% of the overall

improvement in landings. Beginning in 1997, and expanding in 1998, most of the growth in

northern shrimp allocations have been directed toward the inshore fishing sector. The

result has been substantial investment by both the harvesting and processing sectors in a

growth area that generated substantial economic benefits throughout many areas of the

Province. Between 1993 and 1998, shrimp quotas in the Atlantic region have mushroomed from

51,601 to 84,960 tonnes reflecting strong growth in the resource. Shrimp landings for the

year are expected to approximate 55,000 tonnes which, if realized, would make it the

number one species currently prosecuted by the industry, and the Province one of the

largest producers of cold water shrimp in the world.

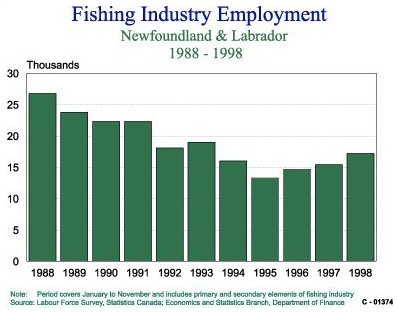

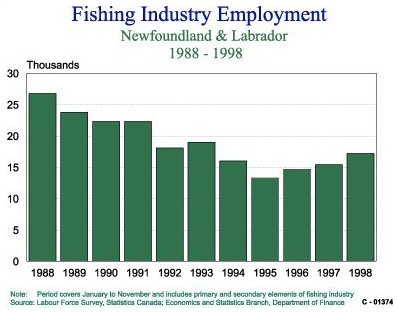

Continued improvement in the shellfish sector has

helped offset the employment losses caused mainly by the decline in the groundfish sector.

Between January and November of this year, average employment gains of about 900 in both

primary (from 9,900 to 10,800) and processing (from 5,500 to 6,400) activities represent

improvements of approximately 9.6 and 16.8%, respectively, from the same period last year.

Employment gains in fishing activity accounted for 29% of the total employment gain

achieved this year. However, as apparent in the diagram, the gains in recent years have

not been sufficient to fully offset the employment losses stemming from others segments of

the fishery.

Continued improvement in the shellfish sector has

helped offset the employment losses caused mainly by the decline in the groundfish sector.

Between January and November of this year, average employment gains of about 900 in both

primary (from 9,900 to 10,800) and processing (from 5,500 to 6,400) activities represent

improvements of approximately 9.6 and 16.8%, respectively, from the same period last year.

Employment gains in fishing activity accounted for 29% of the total employment gain

achieved this year. However, as apparent in the diagram, the gains in recent years have

not been sufficient to fully offset the employment losses stemming from others segments of

the fishery.

In regions where alternative species have not been caught or processed,

income replacement programs initiated at the outset of the groundfish crisis have been the

major source of income for many. Industry workers in Newfoundland and Labrador accounted

for about 68% of the 16,700 people eligible to receive benefits under The Atlantic

Groundfish Strategy (TAGS) when it officially expired September 1, 1998. (It should be

noted, however, that not all who were eligible to receive benefits necessarily did, or

depended on TAGS to the same degree.) In June 1998, the Federal Government announced its

final response to the groundfish crisis. The post-TAGS program contains in excess of $500

million for the Province. Funding covers four major areas including: early retirement;

licence buy-outs; lump-sum payments and mobility assistance; and economic diversification

measures.

Recent

Investments in the Fishery

|

- $60 million in shrimp

processing facilities

$3 million in seal tanning plants

$1.2 million in processing capacity for new species such as whelk and

sea urchins

$8-10 million upgrading and modernization of the crab processing sector

$50 million upgrading and modernization of fishing vessels

|

To conclude, the fishery continues to be an industry in transition. This

is not unlike the experience of fisheries elsewhere. The move to an industry increasingly

dominated by shellfish has resulted in increased diversification within the fisheries

sector. The opportunities and challenges that have been presented by the strong growth in

species like crab and shrimp are ones that continue to be met successfully by industry.

This is reflected, for example, by the fact that millions of dollars were invested this

year in six shrimp processing operations to acquire technology and make the changes

necessary to process new products. As well, hundreds of boat owners have made significant

commitments to upgrade their vessels to harvest and deliver a quality product.

Contents Previous Next

Fish landings appear to be

headed to a higher level for the fourth consecutive year led mainly by strong gains in

capelin, crab, and shrimp. Total landings in the January to September period were up by

about 30 percent over the same period last year. These results are ahead of earlier

expectations, however, given the early start of the crab fishery in particular,

performance on a year-over-year basis should gravitate toward the Province's forecast of

about 15 percent made in the Spring. Other major fisheries commenced on time in line with

weather and resource conditions.

Fish landings appear to be

headed to a higher level for the fourth consecutive year led mainly by strong gains in

capelin, crab, and shrimp. Total landings in the January to September period were up by

about 30 percent over the same period last year. These results are ahead of earlier

expectations, however, given the early start of the crab fishery in particular,

performance on a year-over-year basis should gravitate toward the Province's forecast of

about 15 percent made in the Spring. Other major fisheries commenced on time in line with

weather and resource conditions. Fish Landings (tonnes)

Fish Landings (tonnes) Continued improvement in the shellfish sector has

helped offset the employment losses caused mainly by the decline in the groundfish sector.

Between January and November of this year, average employment gains of about 900 in both

primary (from 9,900 to 10,800) and processing (from 5,500 to 6,400) activities represent

improvements of approximately 9.6 and 16.8%, respectively, from the same period last year.

Employment gains in fishing activity accounted for 29% of the total employment gain

achieved this year. However, as apparent in the diagram, the gains in recent years have

not been sufficient to fully offset the employment losses stemming from others segments of

the fishery.

Continued improvement in the shellfish sector has

helped offset the employment losses caused mainly by the decline in the groundfish sector.

Between January and November of this year, average employment gains of about 900 in both

primary (from 9,900 to 10,800) and processing (from 5,500 to 6,400) activities represent

improvements of approximately 9.6 and 16.8%, respectively, from the same period last year.

Employment gains in fishing activity accounted for 29% of the total employment gain

achieved this year. However, as apparent in the diagram, the gains in recent years have

not been sufficient to fully offset the employment losses stemming from others segments of

the fishery.